Join Us

When it comes to managing your money, there's a better way and a better place–Azura Credit Union.

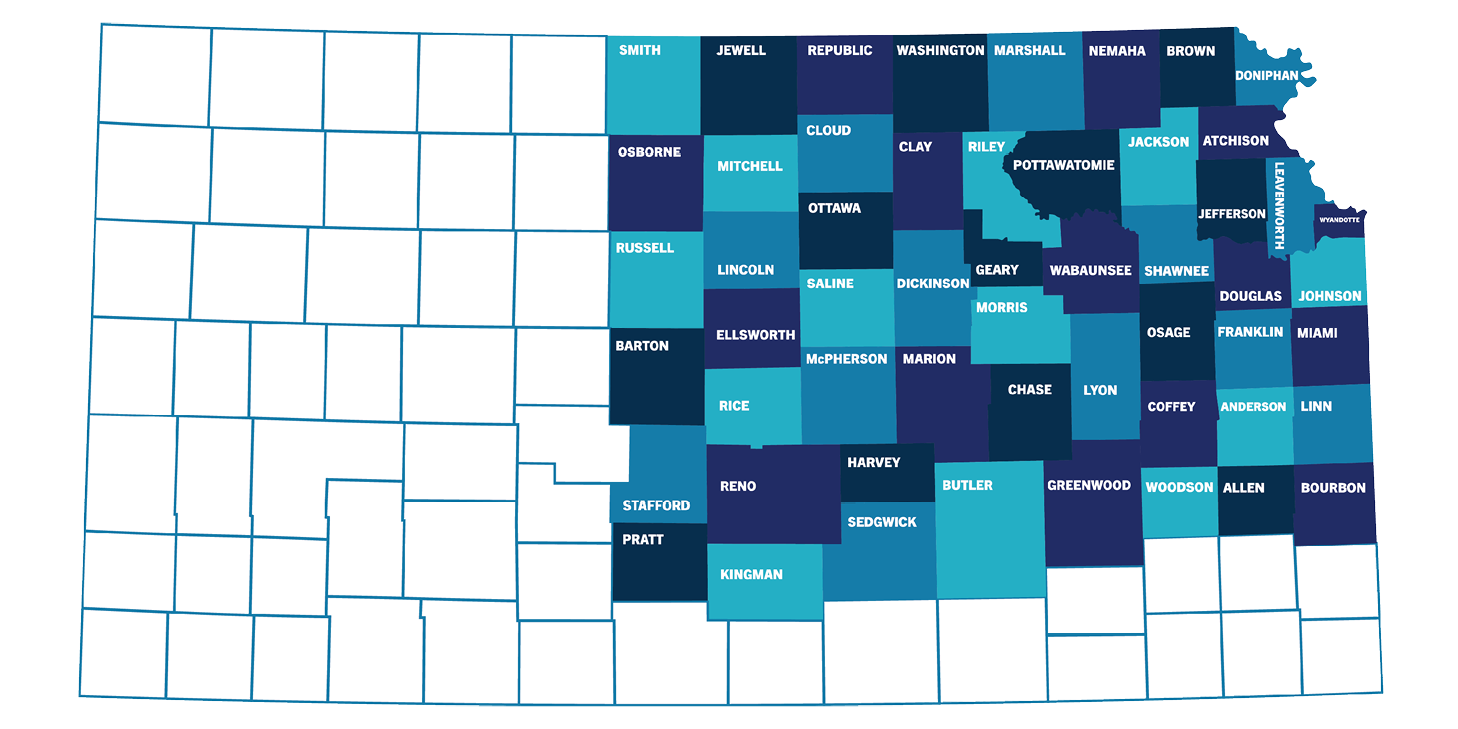

| Allen | Harvey | Osborne |

| Anderson | Jackson | Ottawa |

| Atchison | Jefferson | Pottawatomie |

| Barton | Jewell | Pratt |

| Bourbon | Johnson | Reno |

| Brown | Kingman | Republic |

| Butler | Leavenworth | Rice |

| Chase | Lincoln | Riley |

| Clay | Linn | Russell |

| Cloud | Lyon | Saline |

| Coffey | Marion | Sedgwick |

| Dickinson | Marshall | Shawnee |

| Doniphan | McPherson | Smith |

| Douglas | Miami | Stafford |

| Ellsworth | Mitchell | Wabaunsee |

| Franklin | Morris | Washington |

| Geary | Nemaha | Woodson |

| Greenwood | Osage | Wyandotte |

I had an account with a different bank since I was 12 years old. My mother was a teller for the bank, and I have memories of visiting her at work from a young age. Once I was older, I realized how to that bank, I and even my mother, were just a number to them. Outrageous overdraft fees, even with plenty of money in savings. Crazy interest rates on any kind of loan. And customer service that made you feel like you were an inconvenience. I loathed having to go to the bank for anything...But once I got married, my wife told me about Azura. How she always loved it, and they were great to work with. I couldn't believe the difference! People treating you like a neighbor when you enter the lobby.I tell anyone with questions about their banking that they should switch to Azura! When I help my four kids open their first bank accounts, it will definitely be with Azura Credit Union! Thank you so much.

Max

Azura Member