A "Spring Break" Down of Benefits:

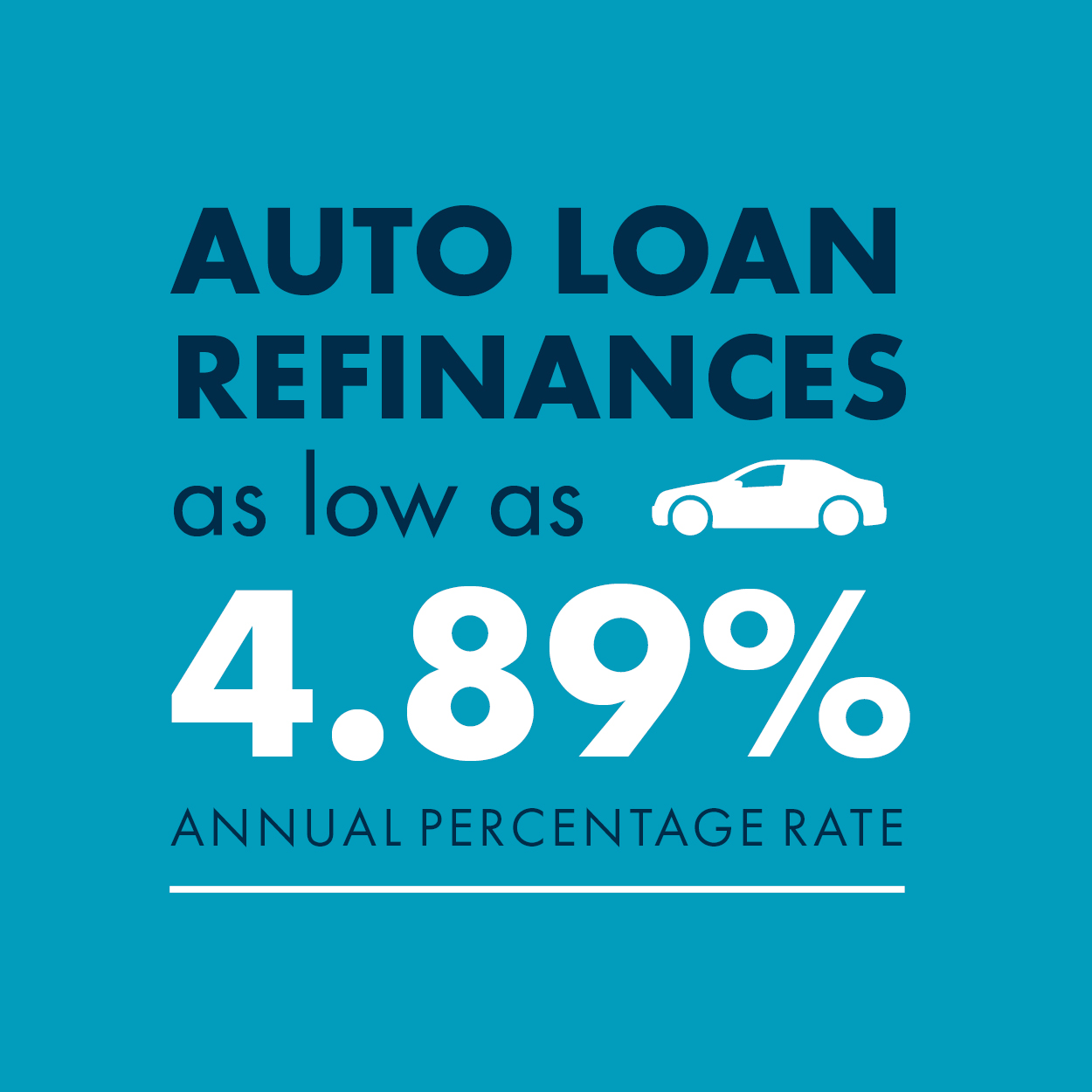

- Rates as low as 4.89% APR*

- No payment for 60 days**

- Up to 72-month term

- Quick approvals and origination

- Personal service and local decisions

- Automatic payment options

- Free e-statements

- Optional credit insurance

*APR=Annual Percentage Rate. Rate and term are subject to credit approval and qualified collateral. Rate valid on auto loans March 17-22, 2025, with approved credit and Auto Pay. Existing Azura auto loans do not qualify. Minimum $10,000 loan up to 60 months and $15,000 for 72 months. Maximum term 72 months. No additional discounts. Loan must fund by April 11, 2025. Equal Opportunity Lender.

Payment Examples: $30,000 at 4.89% APR* for 60 months equals $566 per month or $30,000 at 72 months at 5.36% APR would make monthly payments of $490.

**No payments for 60 days option available to qualified borrowers. Interest will accrue during 60-day deferment period. First payment must be made beginning in the third month on the due date disclosed in the loan agreement.

What you can expect from Azura.

- Auto loan terms up to 72 months for the Spring Break Refi Sale

Payment Protection Options

Guaranteed Asset Protection Advantage

If your vehicle is stolen or totaled in a major accident, your loss could add up to more than its value. Most insurance policies only cover the value of your vehicle at the time of loss, which means that the settlement you receive could be less than the amount you owe. GAP Advantage protects you by covering the “gap” between the vehicle’s value and the amount you still owe.Route 66 Extended Warranty

Route 66 Warranty has a complete line of coverage designed to keep your vehicle on the road. They offer the most comprehensive mechanical breakdown coverage for all makes and models of automobiles. Event the most reliable vehicle can develop a mechanical problem, that’s why so many people depend on Route 66 Warranty. No matter where you are in the United States, they protect you against major mechanical expenses, and there is no deductible on covered parts or labor.Auto Advantage Program

Should you suffer a loss during the benefit period that is covered by the Member's Auto Insurance Policy, you may be entitled to reimbursement of the Auto Insurance Policy deductible amount up to $500 per loss. To be eligible for reimbursement, you must own or lease and insure the Covered Auto under an Auto Insurance Policy designating you, the Azura member as the Auto Policy Named Insured.Real Stories from Real People

I haven't been an Azura member long; but, it was long enough to know I definitely want my next auto loan with them! The customer service I received was a true comfort in the midst of the storm following an auto accident. Thank you, Azura, for helping make my and my service dog's dreams come true!

- Matt C.

Azura Member